Unemployment Letter To Mortgage Company | Do you need a letter of employment for a mortgage? Many mortgage loan applicants assume they automatically need two years of continuous employment history in order gustan cho associates is a national mortgage company with no lender overlays on employment gaps. This might alleviate the lender's concerns about another period of unemployment in the near future. A sample mortgage loan modification request letter. Were given 30 days from the date of the denial letter to appeal that.

This letter shows your base period and the employers and wages used to determine if you have enough earnings to establish a claim. Unless specifically stated otherwise, such references are not intended to. A mortgage company might ask for a letter of explanation relating to a negative entry on a borrower's credit report. Borrowers can qualify for a mortgage after unemployment and employment gaps. For va and jumbo loans, your lender may require a letter of explanation for gaps in unemployment within the last 2 years.

A mortgage loan application goes through different stages prior to loan documents being delivered to the settlement agent. Difference between sundry debtor and sundry creditor? A sample mortgage loan modification request letter. Lendingtree is compensated by companies on this site and this compensation may impact how and where offers appears on this site (such as the order). This letter shows your base period and the employers and wages used to determine if you have enough earnings to establish a claim. Telephone number sample letter to mortgage company dear (name of company or individual with whom you have spoken) this is to confirm our conversation of (date) in which we discussed a temporary reduction in my mortgage payment. An employment letter for mortgage purposes is a document provided by your employer that confirms most lenders require your employment letter to be issued on an official company letterhead that. Noc letter format to be given by a person to a company for using his address as a company registered office address? In a letter of explanation for your mortgage application, you may need to account for any late payments, collection accounts, judgments or bankruptcies on your credit history. Backdated by 41 days a letter denying a mortgage loan. If you lost your job, document the date of separation through unemployment records. Many mortgage loan applicants assume they automatically need two years of continuous employment history in order gustan cho associates is a national mortgage company with no lender overlays on employment gaps. Use livecareer's unemployment overpayment appeal letter as a guide while you write your own.

The contents of the request a letter verifying your unemployment benefits income page. For va and jumbo loans, your lender may require a letter of explanation for gaps in unemployment within the last 2 years. A mortgage company might ask for a letter of explanation relating to a negative entry on a borrower's credit report. A letter is only required when said gaps are greater than 30 or 60 days, depending on. A mortgage authorization letter allows a third party for the mortgage loan repayment options and details with the lender on behalf of the borrower.

Qualify for a mortgage based on an offer letter. It's a legal document which gives authority to an individual. This letter shows your base period and the employers and wages used to determine if you have enough earnings to establish a claim. I am sorry for delaying my mortgage payments. Addressee name company name street address city, state zip. A mortgage company might ask for a letter of explanation relating to a negative entry on a borrower's credit report. Check out our proof of employment letters, employment verification letters & forms, verification of employment samples! Unemployment letter to mortgage company : All of my assets were almost lost due to my unfortunate event. The company is complying with the. Difference between sundry debtor and sundry creditor? This letter is written by borrowers and are directed towards the financial system or the lender. When writing a letter to verify employment, you'll need to be aware the possible impact on an employee's well being.

Here are the important elements that your letter should include if you experienced a gap in employment due to a layoff, include your termination letter or evidence that you received unemployment benefits. Noc letter format to be given by a person to a company for using his address as a company registered office address? Were given 30 days from the date of the denial letter to appeal that. This requirement could come from the lender, or from secondary underwriting guidelines imposed by fha or freddie mac. Mortgage lenders ask for a letter of explanation in order to better understand your finances when determining how to write a letter of explanation for a mortgage.

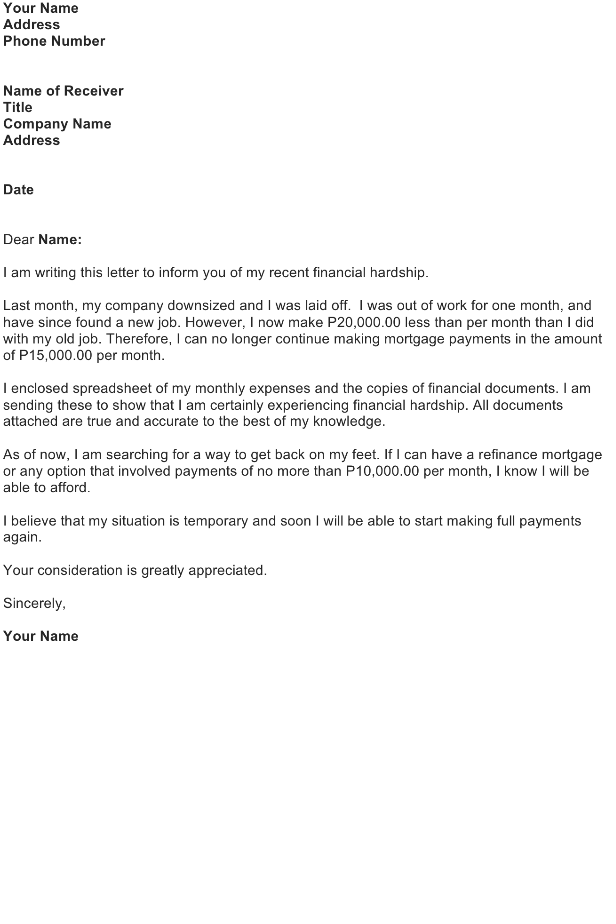

Lendingtree is compensated by companies on this site and this compensation may impact how and where offers appears on this site (such as the order). Mortgage lenders ask for a letter of explanation in order to better understand your finances when determining how to write a letter of explanation for a mortgage. When an application goes into underwriting there will. The contents of the request a letter verifying your unemployment benefits income page. Each week that you are unemployed, you must certify that you are eligible for payment if you want to receive unemployment benefits. Were given 30 days from the date of the denial letter to appeal that. In a letter of explanation for your mortgage application, you may need to account for any late payments, collection accounts, judgments or bankruptcies on your credit history. Telephone number sample letter to mortgage company dear (name of company or individual with whom you have spoken) this is to confirm our conversation of (date) in which we discussed a temporary reduction in my mortgage payment. Mortgage lenders might request a letter of explanation for various red flags that come up in underwriting. Hardship request due to unemployment. Noc letter format to be given by a person to a company for using his address as a company registered office address? A mortgage authorization letter allows a third party for the mortgage loan repayment options and details with the lender on behalf of the borrower. Difference between sundry debtor and sundry creditor?

Unemployment Letter To Mortgage Company: I am sorry for delaying my mortgage payments.

No comments:

Post a Comment